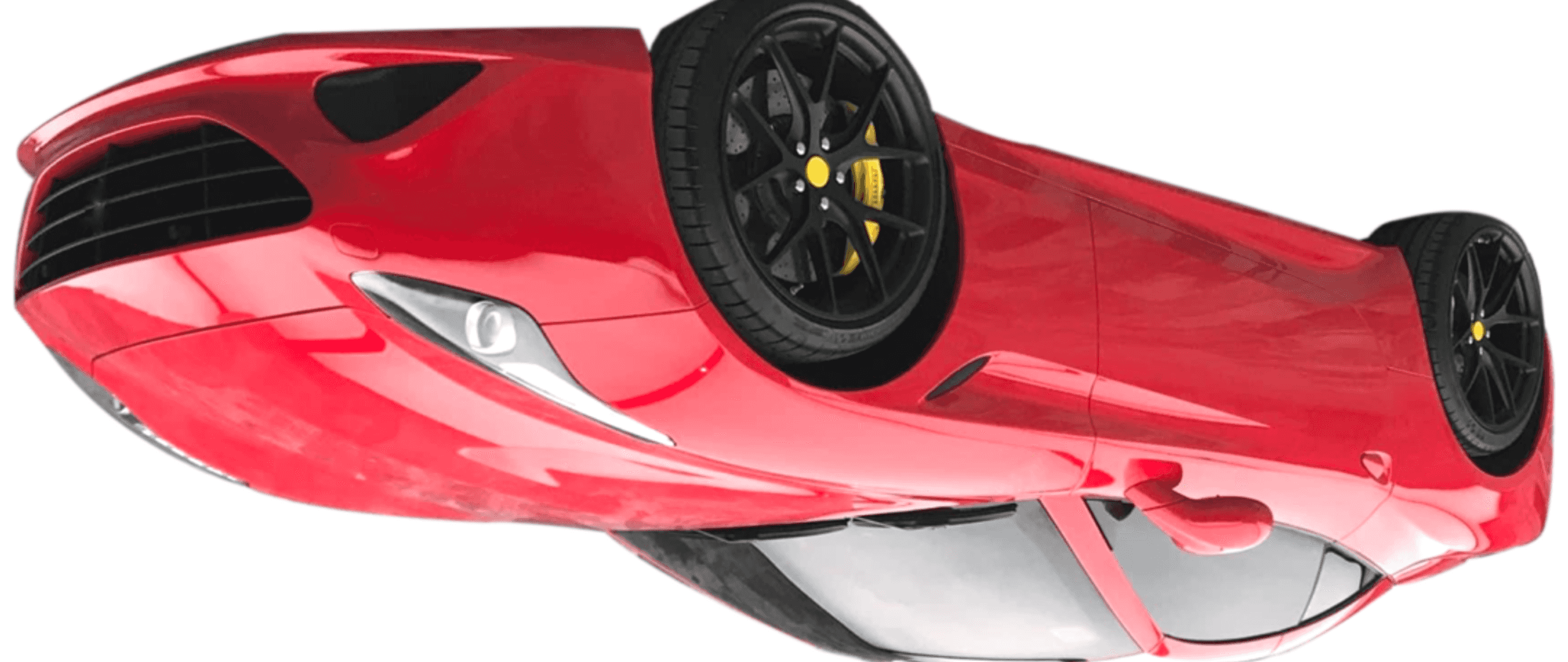

An Upside Down Loan

When you have an upside-down loan, a car loan for example, you owe more on your car than it’s worth. The same is true with regard to mortgages when the principal is higher than the home value. Being upside-down on a loan can lead to financial hardship so it’s important to take action to eliminate negative equity.

Everyone knows that a new car immediately depreciates in value the minute it is driven off the lot. New cars also come with high monthly payments. Yet those facts don’t seem to stop car buyers from financing expensive vehicles they really can’t afford. They failed to understand the cost of owning the car before driving it off the lot.

A homeowner who originally made a sound investment may end up with an upside-down mortgage if there’s a decrease in property value, or if they experience a personal hardship that causes them to miss mortgage payments. Anyone who purchased a home in 2007 experienced a drastic decrease in property value by the fall of 2008. The Crash resulted in over 3 million Americans filing for foreclosure.

To turn an upside-down loan “right-side up”, you can

- Make additional monthly principal payments.

- Refinance to a shorter-term loan.

- Sell the asset and take out a new loan.

Keep in mind that with regards to a car, boat, or motorcycle it may be a challenge to refinance depending on the balance owed and your credit score. Selling the asset or rolling it into a new loan may require paying off the difference. Consider purchasing gap insurance to protect yourself in the event of a collision that results in your car being totaled.