Tax Reform Highlights

Tax Reform Highlights

Here are some brief updates about the tax bill that was recently passed. Keep in mind that the industry is still working through the ramifications of the legislation; there will be much more in-depth information coming throughout the year.

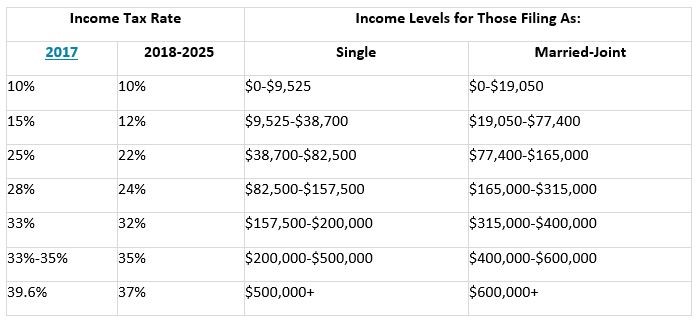

New Income Tax Rates

- The tax brackets for individuals have been lowered for everyone except the lowest bracket, until 2026, when they revert back to 2017 rates. (Employees will see the lowered withholding on their February 2018 paychecks.)

- The bracket income levels will rise each year with inflation, because they are now tied to the chained consumer price index. Over time, this will move more people into higher tax brackets.

- The corporate tax rate was lowered from 35 to 21 percent, the lowest it’s been since 1939. Per the legislation, this lowered rate never expires.

Standard Deduction

- The standard deduction doubles from $6,350 to $12,000 for single filers and from $12,700 to $24,000 for married/joint filers; it is projected that 94 percent of taxpayers will take the standard deduction, especially since many other deductions have been lowered or removed. The standard deduction will revert back to 2017 levels in 2026.

Personal Exemptions

- Starting in 2018, taxpayers will no longer be able to subtract $4,150 from income for each person claimed. As a result, some bigger families may pay higher taxes.

Alternative Minimum Tax

- The alternative minimum tax is retained, and the exemption is increased from $54,300 to $70,300 for singles and from $84,500 to $109,400 for joint filers. (The alternative minimum tax is not available at $500,000 for singles and $1 million for joint filers.) The exemption reverts to 2017 levels in 2026.

Homeownership

- Mortgage interest remains deductible for the most part, but is limited to the interest on a maximum of $750,000 (down from $1 million) on home loans going forward. Current mortgages are not affected.

- New restrictions on property tax deductions could make homes out of reach for some. Income tax deductions for state and local taxes are now capped at $10,000 per year, and taxpayers must choose between deducting property taxes or income/sales taxes.

- Home equity loan interest is no longer tax deductible, starting in 2018.

- One key homeownership benefit stayed intact: If you lived in and owned a home as your primary residence for at least two of the past five years, you may avoid tax–up to $250,000 for singles and $500,000 for married couples.

Itemized Deductions

- The deductions that remain in place for taxpayers include charitable contributions, retirement savings contributions and student loan interest. (You have to itemize and cannot take the standard deduction in 2018 in order to deduct these expenses.)

- The deductions no longer available starting 2018 include moving expenses (except for military), fees for tax and financial advice, home equity loan interest, and alimony payments. (People receiving alimony are now able to deduct it.)

Healthcare

- Starting in 2019, there is no mandate for having health insurance, therefore no tax penalty as instituted by the Affordable Care Act (“Obamacare”).

- In the past, medical expenses could be deducted only if they exceeded 10 percent of adjusted gross income. The new law lowers that threshold to 7.5 percent for 2017 and 2018, allowing more health-care costs to be written off. (NOTE: People 65+ have already had the lower threshold.) These lower thresholds expire for everyone in 2019.

Estate Taxes

- The estate tax exemption doubled to $11.2 million for singles and $22.4 million for couples. The exemption reverts back to 2017 levels in 2026.

Let’s get together and talk about tax planning. Call Alloy Wealth Management in Charlotte, NC at (800) 689-3935.

Sources:

“Tax reform could alter some financial tips, strategies.” Azcentral.com https://www.azcentral.com/story/money/business/consumers/2018/01/07/tax-reform-could-alter-some-financial-tips-strategies/995984001/ (accessed January 8, 2018.)

“Trump’s Tax Plan and How It Affects You.” Thebalance.com. https://www.thebalance.com/trump-s-tax-plan-how-it-affects-you-4113968 (accessed January 8, 2018).

“GOP tax bill expands medical expense deduction for two years.” CNBC.com. https://www.cnbc.com/2017/12/16/gop-tax-bill-expands-medical-expense-deduction-for-two-years.html (accessed January 8, 2018).