When should you begin collecting Social Security? It’s complicated.

The question of when to file for Social Security benefits might seem simple—until you get into your 60s and start learning about the dozens of ways to file, especially if you are married.

The age consideration alone is your first big decision.

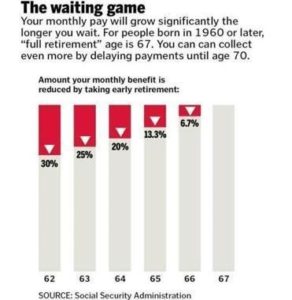

- You can file as early as age 62—for a reduced benefit of around 70% of what you will get if you wait until your full retirement age. (So how old is that, you might ask?)

- Full retirement age used to be 65, but now it’s 66 or 67, depending on your month and year of birth. If you were born in 1960 or after, your full retirement age is 67.*

- For every year you wait to retire up to age 70, your benefit increases by 8%, plus any COLA (cost of living adjustment) each year.

It doesn’t make any sense to wait after you reach age 70 because there will not be any more increases to your benefit. Plus, you want to make sure you live (and collect benefits) long enough to “break even”—which is typically is between ages 80 and 82—or even better, collect more than you actually paid in to the system via payroll reductions your whole life.

Social Security represents the largest chunk of retirement income for most Americans. The benefit is calculated through a formula averaging three and a half decades of inflation-adjusted taxable income. If you’ve worked more than 35 years, it averages your highest 35 years; if you’ve worked less than 35 years, your benefits will be lowered by averaging in zero for each year you didn’t work.

In deciding when to file, you should consider your health, your savings, what timeline is best for you in terms of when to stop working, and your plans for your retirement years. Circumstances are different for everyone, and it’s a very personal decision.

Even though in general it’s best to wait until age 70 if your income and expenses permit it, “That may not be feasible for many Americans,” says Mark Henry, our CEO and founder of Alloy Wealth Management in Charlotte, N.C.

Mark was recently interviewed and featured in The Boston Globe.

He has noticed that many of his clients, after spending decades paying into the system, are eager to begin recouping. “If you’re still working, it makes sense to wait till after 66. But as soon as you stop working, you need money. Then sooner is better.”

Mark recalls walking a client through his options and determining that his break-even age was 82. “I told him, ‘After that, it’s all profit,’ ” I said. “He looked at me and said, ‘Mark, there’s never been a man in my family who made it to age 82.’ I told him, ‘Just turn it on now.’ ”

You can read the whole article here: “When should I start taking Social Security? 60-somethings want to know.”

NOTE: If you decide to delay your retirement, be sure to sign up for Medicare at age 65, because in some circumstances, medical insurance costs more—permanently—if you delay applying for it.

Call us at (800) 689-3935 if you have any questions.